Stage 1

Developing a broad target list, casting the widest possible net, maximum options will be gathered.

While, at minimum, a list of potential targets will be produced – a second layer of information will add deeper criteria, such as unique, pivotal characteristics that increase the potential value of a specific target.

Examples of this include condition of the current installed mechanical systems (bad=good), a location or building type that can increase offsetting subsidy funding opportunities (zoning, affordable tenant mix, violation status for LL 11 or 97, etc), or location matched with condition showing increased potential for higher valuation or appreciation.

We will explore potential to expand criteria for

- Building typology & size

- Building use & occupancy

- Ownership structure

- Efficiency upgrade potential

- Construction typology

- Urban context

- Zoning requirements

- Existing operational and embodied CO2e

- Recently constructed 10-15 year old 421A Buildings

- Geographical area (NYC only Boston? NJ? CT? )

- Time horizon (gather data on buildings not yet listed for sale such as future LL97 violators?)

- Use funding strategy filters: check Dept. of Building public list for FISP / LL11 violators

- Public & Nonprofit Partner assistance potential

Expanded Search > Enhanced Categories > Architechtural and Funding Criteria

Seeking additional strategic ideas for increasing the mix of positive “adjustments” will also be part of the early stage process.

Examples already known are as above, generally including negotiated price potential based on near-end-of-life components, facade damage or age, availability of specific incentives, etc. Added to this list will be as-of-yet unknown methods and positive factors to be discovered during stage 1 information gathering.

A database will be compiled for all leads, focused on targets with the potential to reach stage 2.

Public resource examples:

Stage 2

Candidates from stage 1 can be upgraded at any time to stage 2 status. When a target asset reaches stage 2, an initial report will be made, listing the various potential attributes gathered in stage 1 which qualify it for further scrutiny.

This report will be provided and any further investigation can be agreed on – possible site visit or gathering of blueprints or building specs, photos etc, will be used to start the process of consideration for stage 3.

Consensus will be built for Stage 3 nomination through the creation of a report, using EE projections and an informal outline for a full feature project YR retrofit package plus input on the RE side as available.

The goal of this pre-diligence will be to qualify the target building for stage 3A at which time formal reports, case studies and overall diligence can begin.

Initial Asset Report > Deeper Data Search > Attribute Verification > 3A Qualification Confirmation

Since all target assets that reach this stage will be nominated based on special circumstances that have been pre-visualized, the ascent to 3A will depend on those original projections being confirmed and further specified using any additional data discovered in the added scrutiny phase.

A category designation for the target should be assigned at this time – priority will be given to GSHR and HR buildings.

Stage 3A

Any property that emerges from stage 2 will have multiple favorable factors that support a retrofit plan. These factors would be confirmed and measured, through a feasibility study, a formal energy modeling assessment or even a complete case study as deemed necessary.

Reports Comissioned > Initial Diligence Starts > Yeti Plan & ULS Development

Ballpark estimates of costs for the total retrofit package as well as GHG mitigation and efficiency gains will be calculated at this stage

By using a formula created by taking all favorable factors, such as those that reduce the purchase price, including LL 11 repairs, end of life heating system status and others, along with and grants or other positive external funding or benefit (tax reductions, FAR exemptions, etc) a “real” cost profile can be calculated.

This then, can be compared against anticipated GHG performance and utility cost reductions over time, plus any other important success metrics. When the sum of all the factors above are favorable this can trigger a “green light” to move on to the next stage.

Stage 3B

As the purchase proceeds the retrofit formal planning stage can begin. The designs and planning stage can either begin immediately, unless dependent on factors and information that are still outstanding.

Consortium members for MEP and Energy Technology will be activated and the process for a full implementation can commence while a building is changing ownership.

With stages 1-3A complete a showcase GSHR can begin to manifest, first in virtual form, followed by physical, spectacular reality.

Design and Planning > Ownership Transfer > ULS Consortium Activation: Go Time

Stage 3A Reports and Diligence

Rather than a low ROI data gathering exercise in earlier search stages, focusing this activity into stage 3A has many benefits. The familiarity of the asset will be established, and during the early diligence phase this can be augmented with formal studies.

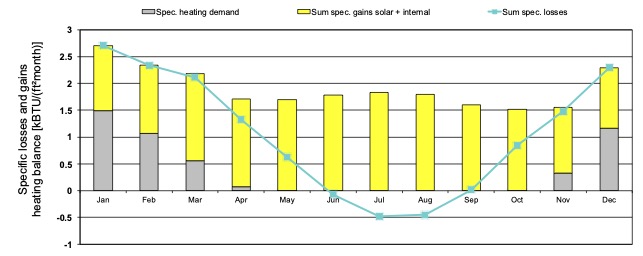

Energy modeling using this method can be a cornerstone in retrofit planning and value calculation.

Additionally, during this stage, 3rd party entities can be engaged, on an “as needed” basis, supplementing in-house production.

Using Drones to Conduct Façade Inspections

PDF

Energy audits

Examples of data reports that may be accessed in stage 3A:

- Energy Audits

- Feasibility Studies

- Compliance Assessments

- Solar PV Feasibility

- Battery Storage Feasibility

- Benchmarking,

- Analysis & Monitoring

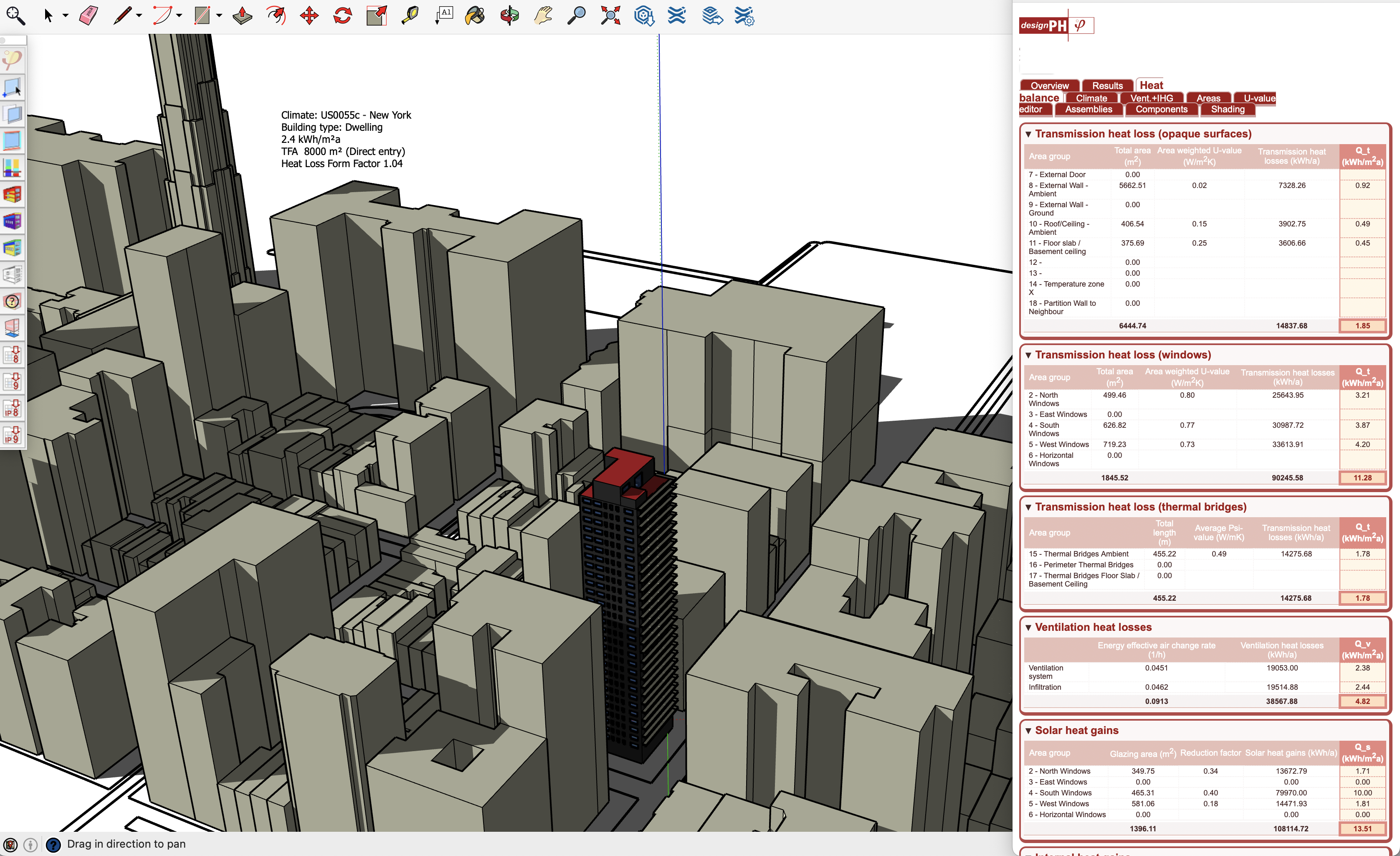

One method that could be particularly efficient is to gather geometric data using a drone survey, which can be used to create a 3D computer model of each target asset. The model (similar to the one seen in the example below) can then be routed into various software platforms for energy modeling, and initial planning for the Yeti retrofit.

Foundation Concept Matrix

— Database Development

— Cast widest possible net

— Build System and Best Practices

— Create System and Methodology Handbook

— Begin Building Yeti ULS Consortium

— Establish Communication and Collaboration Protocols

— Begin 10 Year Business Model Development

— Training and Education of Principals

Catalytic Expansion Matrix